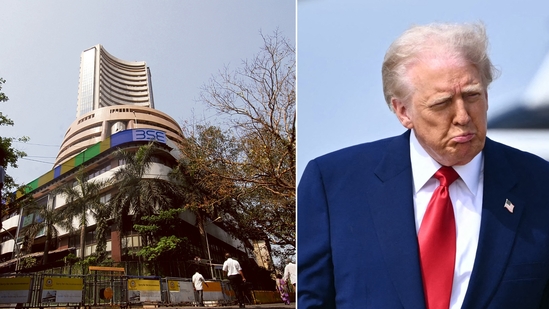

Indian Stock Market Crash: Rs 20 Lakh Crore Wiped Out in Just 10 Seconds Due to Trump Tariffs 📉

Indian Stock Market Crash: Rs 20 Lakh Crore Wiped Out in Just 10 Seconds Due to Trump Tariffs: In a shocking turn of events, the Indian stock market experienced a catastrophic crash today, erasing a staggering Rs 20 lakh crore in value within a mere 10 seconds. This unprecedented decline has sent shockwaves through the financial community and raised concerns among investors about the future stability of the market.

▎The Catalyst: Trump Tariffs – The sudden plunge in the Indian stock markets can be traced back to the announcement of new tariffs by former U.S. President Donald Trump. These tariffs, aimed primarily at China, have far-reaching implications for global trade and economic stability. Investors reacted swiftly to the news, fearing that escalating trade tensions could lead to a slowdown in economic growth, not just in India but across the globe.

▎Market Reaction: As trading commenced today, the Sensex and Nifty indices plummeted, with heavy selling observed across various sectors. The initial reaction was so severe that trading on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) was temporarily halted to prevent further panic selling. Analysts noted that the speed of the decline was unprecedented, highlighting the heightened volatility in the current market environment.

Link: https://youtube.com/@sasaramvlogs.

▎Impact on Investors: The impact of this crash is profound. Retail investors, who often lack the resources and information available to institutional investors, have been particularly hard hit. Many individuals saw their investments evaporate in seconds, leading to widespread distress and anxiety. Financial advisors are urging investors to remain calm and avoid making impulsive decisions during this turbulent period.

▎Economic Implications: The ramifications of this crash extend beyond just stock prices. A significant decline in market capitalization can lead to reduced consumer confidence and spending, ultimately affecting economic growth. Additionally, foreign investors may reevaluate their positions in Indian markets, which could result in further capital outflows. https://sasaramvlogs.in

▎Looking Ahead: As the dust settles from today’s dramatic events, market analysts are closely monitoring the situation. While some experts believe that this crash could present buying opportunities for long-term investors, others caution against jumping in too quickly without a thorough assessment of the underlying economic conditions.

In Conclusion, today’s crash serves as a stark reminder of the interconnectedness of global markets and the potential impact of geopolitical events on local economies. Investors are advised to stay informed and consider diversifying their portfolios to mitigate risks in these uncertain times.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Always consult with a financial advisor before making investment decisions.

Too much volatility