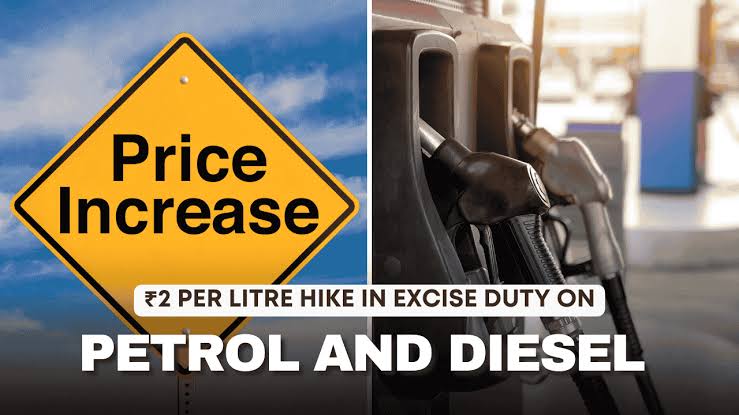

Indian Govt Increases Excise Duty on Petrol and Diesel by Rs 2: What It Means for Consumers

Indian Govt increases excise duty on petrol and diesel by Rs 2: In a recent move that has sparked discussions across the nation, the government has announced an increase in excise duty on petrol and diesel by Rs 2 per liter. This decision, which comes amid fluctuating global oil prices and rising inflation, is expected to have significant implications for consumers, businesses, and the economy as a whole.

▎Understanding the Excise Duty Hike: Excise duty is a form of indirect tax imposed on the manufacture, sale, or consumption of goods within a country. The increase in excise duty on petrol and diesel means that consumers will now pay more at the pump for these essential fuels. This decision is part of the indian government’s broader fiscal strategy to generate additional revenue, which can be utilized for various developmental projects and initiatives. https://sasaramvlogs.in

▎Reasons Behind the Increase:

- Revenue Generation: The Indian government is facing mounting pressure to boost its revenue amid rising expenditure. The additional revenue from the increased excise duty could help fund infrastructure projects and social welfare schemes.

- Global Oil Prices: Fluctuations in global oil prices have a direct impact on domestic fuel prices. By increasing excise duty, the government aims to cushion the fiscal impact of rising import costs while maintaining its budgetary commitments.

- Inflation Control: While increasing taxes on fuel may seem counterintuitive in an inflationary environment, the indian government might be banking on controlling inflation through other measures, such as reducing subsidies or improving supply chains.

Link: https://youtube.com/@sasaramvlogs.

▎Implications for Consumers:

- Higher Fuel Prices: The immediate effect of the excise duty increase will be a rise in petrol and diesel prices. Consumers can expect to see this reflected at fuel stations, leading to increased costs for personal transportation and logistics.

- Impact on Daily Expenses: With higher fuel prices, the cost of goods and services may also rise. Transportation costs for businesses could lead to increased prices for essential commodities, further straining household budgets.

- Economic Slowdown Concerns: As fuel prices rise, there are concerns about potential impacts on consumer spending and economic growth. Higher fuel costs can lead to reduced disposable income for families, affecting their spending habits.

▎Reactions from Stakeholders: The announcement has elicited mixed reactions from various stakeholders: • Consumers: Many consumers are expressing frustration over the increasing cost of living and the burden of higher fuel prices. • Business Owners: Small business owners, particularly those in logistics and transportation sectors, are worried about how rising fuel costs will affect their operations and profitability. • Economists: Some economists argue that while the indian government needs revenue, increasing excise duties during a time of economic uncertainty may not be the best approach.

▎Conclusion: The Indian government’s decision to increase excise duty on petrol and diesel by Rs 2 per liter is a significant development that will have far-reaching implications for consumers and the economy. As fuel prices rise, it is crucial for households and businesses to adjust their budgets accordingly. Additionally, ongoing monitoring of global oil prices and government policies will be essential to understanding the long-term impacts of this decision.

As always, staying informed about changes in fuel pricing and government policies will help consumers navigate these shifts more effectively!

Hate for Bjp Button ✅

Very bad decision 😕